When it comes to predicting the future of live video, the past isn’t exactly prologue—at least not the very recent past.

Everyone knows that live streaming exploded in popularity in the wake of the COVID-19 pandemic. What started off as a substitute for in-person work and entertainment quickly became a choice, rather than a necessity, as employers realized remote workers could get as much done at home as they could in the office and road warriors realized that what they lost in air miles by not going to conferences and meetings, they more than made up for in increased productivity and time.

Consumers also found that live streaming concerts and other events from the comfort of their own homes was the next-best thing to being there, and artists and promoters realized they’d been leaving money on the table by not offering live streams sooner. After all, no matter how many stops a performer might make on a tour, there are always rabid fans who can’t attend, be it due to geography, timing, or increasingly expensive and hard-to-get tickets.

Even sports leagues, which had always broadcast matches and games, realized that live streaming opened up new opportunities for them to provide fans with an experience that isn’t possible in stadiums.

This is the part of this post where I’m supposed to say “And that unprecedented growth is only going to continue.”

Except it’s not, at least not at the same rates we saw from 2020 to 2022. Prior to launching Norsk, we commissioned Rethink Technology Research to evaluate the state of the live streaming market and forecast where it’s headed in the next five years.

Slowly but Surely

TL;DR: It’s going to continue to grow, but at a steady rate of about 5% per year between now and 2028. And that slow, steady growth is a good thing; I’d much rather see that than a continuation of the hockey stick growth we’ve seen the last few years.

Don’t get me wrong. Who doesn’t love hockey stick growth? But, except in the rarest of cases, it’s unsustainable. Just look at our colleagues in the on-demand streaming market. When the pandemic hit—just after the launch of Disney+ and just before the launch of HBO Max (we hardly knew ya)—the popularity of SVOD services soared. Combine the fact that everybody was stuck at home looking for things to watch with the already-extant cord-cutting movement, and it was party time for streaming services. Every service from Netflix to Amazon Prime Video invested millions into creating and licensing new shows and movies, banking on the fact that the habits formed during lockdowns would stick. And those companies’ investors kept pushing up share prices and market caps, and …

And then consumer behavior changed. People started doing things other than binge watching, and cord cutters began to notice what industry veterans had predicted all along: In the end, the dream of a la carte services with no long-term subscription contracts wasn’t going to actually save consumers any money at all, at least not if they wanted to watch any live sports or news.

The World’s Biggest Ponzi Scheme?

The cost of Netflix plus HBO Max (now Max) plus Apple TV+ plus Disney+ plus YouTube TV or Hulu Live adds up to just about the same amount per month as a typical traditional cable/pay TV bill. And so customers began canceling those services, or at least cycling through them, dropping one when the latest season of their favorite show ended, picking up another, lather, rinse, repeat. According to Antenna Research, the percentage of SVOD subscribers who are “serial churners”—customers who have canceled 3 or more services in the last 24 months—nearly doubled from 15% in 2020 to 29% in 2022. And what’s more, net subscriber additions (gross additions minus cancelations) fell from 13 million in Q4 2021 to 7.5 million in Q4 2022. (The report is behind a registration wall, but some of the topline findings can be found here.)

Like any data, those numbers don’t tell the whole story. The fact that the hockey stick growth in SVOD is slowing down wouldn’t necessarily be a cause for panic, had the value of premium SVOD services not been so overinflated in the first place. Combine that with the amount of money invested in prestige series like Succession, and the SVOD industry definitely is panicking. (Despite what the Twitterverse would have you believe, Succession wasn’t all that popular; the series finale drew 2.93 million viewers, which is less than a random episode of CBS’s Price is Right at Night). In a recent Vulture article called “The Binge Purge,” one anonymous insider is quoted as saying “I think we may be in the world’s biggest Ponzi scheme.”

It’s not just SVOD that’s slowing down, either. The latest Streaming Media State of Streaming Survey, behind a registration wall, suggests that the bloom might be off the FAST (free ad-supported television) rose as well.

Sports Streaming is Growing …

None of this is to suggest that on-demand or live linear streaming is dying, just that the bubble is leaking, if not bursting. Not so with live streaming. The huge growth we saw in 2020 (Insider Intelligence/eMarketer pegs it at 20.4%) quickly contracted, before investors had a chance to get stars in their eyes and heat things up too much. In part, that’s because, as Adrian Pennington writes, major live events like sports have been slower to move to IP delivery because “technically, things are still not sorted.”

But it’s happening, and the numbers are worth paying attention to: Nielsen managing director of audience measurement Deirdre Thomas told Pennington that the first three NFL Thursday Night Football games in the 2022 season attracted more viewers than the previous year’s games on the NFL network. Discovery pulled in more than 1 billion minutes of streaming viewing for the 2022 Beijing Winter Games, 19 times what we saw just four years earlier.

Even SVOD OG Netflix is starting to deliver live streams (and they’ve found out just how hard it can be, but that’s another story …)

… but Corporate and Online Shopping Are Growing Faster

To be honest, though, as eye-watering as those numbers are, they’re not the ones that really matter beyond the headlines. Smaller live-streamed events present the greatest opportunity for suppliers in the digital media space, and the Rethink research indicates that the 2022-2028 growth in corporate events (almost 33% from ~9.7 million to ~12.9 million) and online shopping (35% from ~15.9 million to about 21.4 million) will outpace the growth in sports (almost 31%, from ~551,000 to ~701,000). (I was going to add a chart here comparing the three verticals, but compared to corporate events and online shopping, the sports numbers are practically negligible. Of course, the revenue associated with professional sports is anything but.)

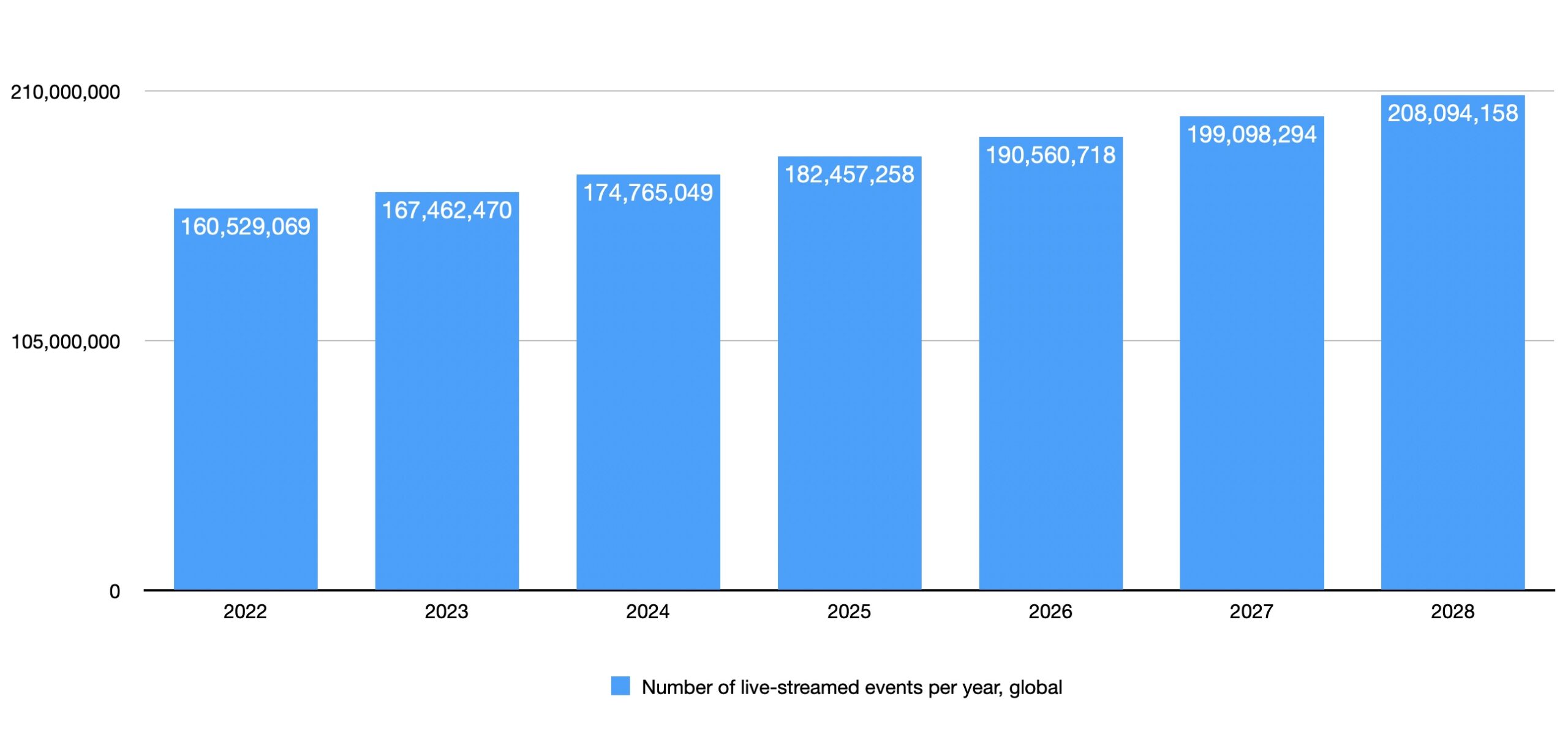

These numbers aren’t that much higher than the aggregate 5% or so growth per year—from ~160.5 million in 2022 to ~208 million in 2028—that Rethink forecasts for all live event streaming, but worth nothing nonetheless. It’s been said enough that it feels like a cliche, but every company is now a media company, and increasingly, every company is a live media company. And while not every company requires a robust live streaming workflow to satisfy its needs (my wife’s art studio does just fine streaming occasionally to Facebook Live), more and more companies find themselves needing to do considerably more than Zoom or Facebook Live or YouTube can handle. (People are frequently shocked when we tell them that Notified, which handles financial fair disclosure meetings among other corporate communications events, streams in the neighborhood of 100,000 events every year.)

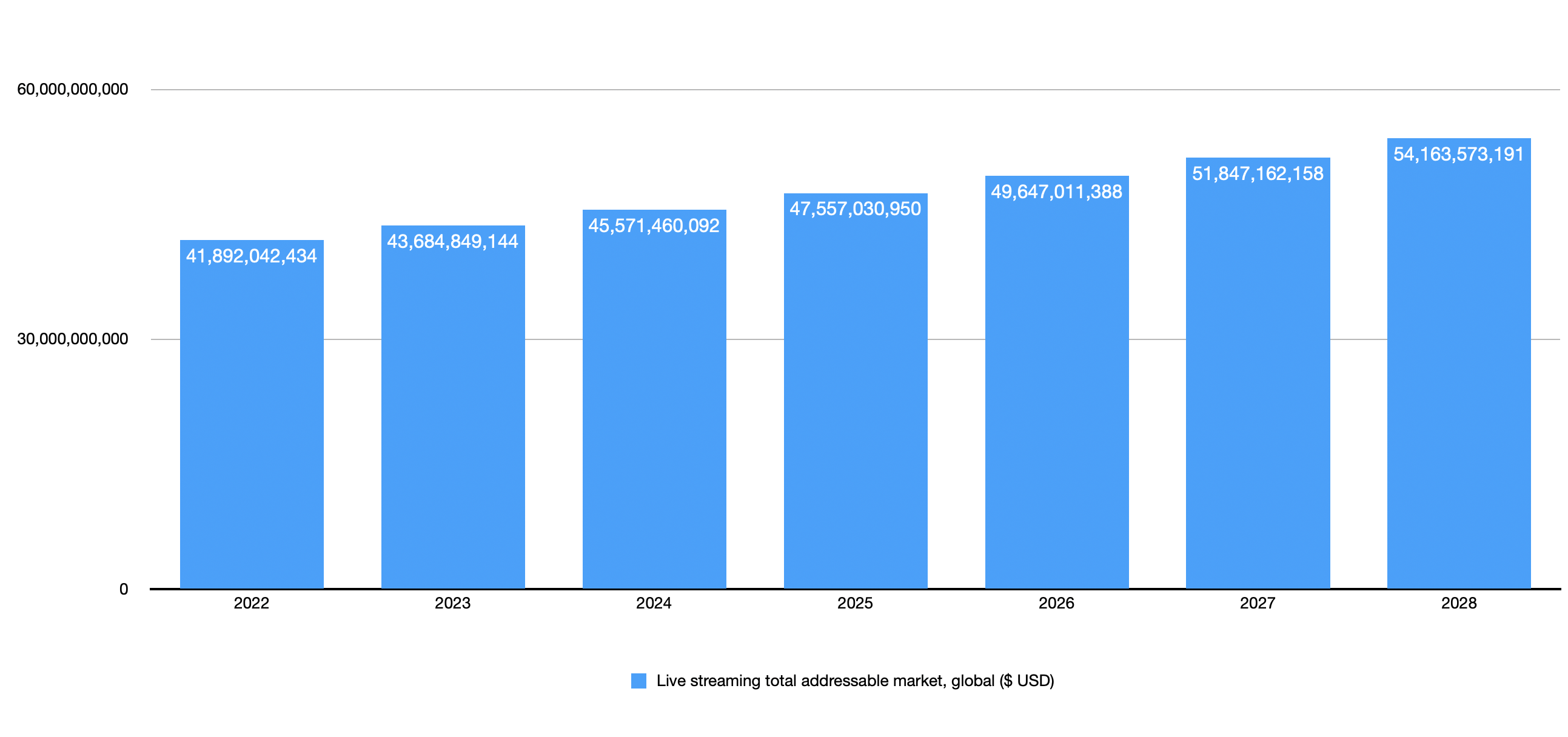

In looking at the total addressable market (TAM) for live streaming, Rethink unsurprisingly came up with a similar ~5% yearly increase, from ~$43 billion this year to ~$54 billion in 2028. To put that into perspective, that 2023 number is somewhere between Netflix’s annual revenue ($31.473 billion) but less than Cisco’s ($51.557 billion).

Even with all the volatility in the SVOD, that market is still much bigger than the live streaming market (one estimate puts it at $257.59 billion by 2029), but live streaming’s steadier growth makes it a better bet. And even though very few live events offer the potential revenue upside of Thursday Night Football, there are literally hundreds of millions of them. And while the sheer number of live streamed events is good news for video platforms and tech suppliers, it means that businesses of all kinds—not just media companies, but any organization using video to reach customers and other stakeholders—need to go the extra mile and make their live streams unique. Get in touch with us to find out how the Norsk low-code live streaming SDK can help you differentiate your live video from your competition’s.